- CryptoCube newsletter

- Posts

- The Crypto Rollercoaster: Why Market Crashes Are Your Secret Weapon

The Crypto Rollercoaster: Why Market Crashes Are Your Secret Weapon

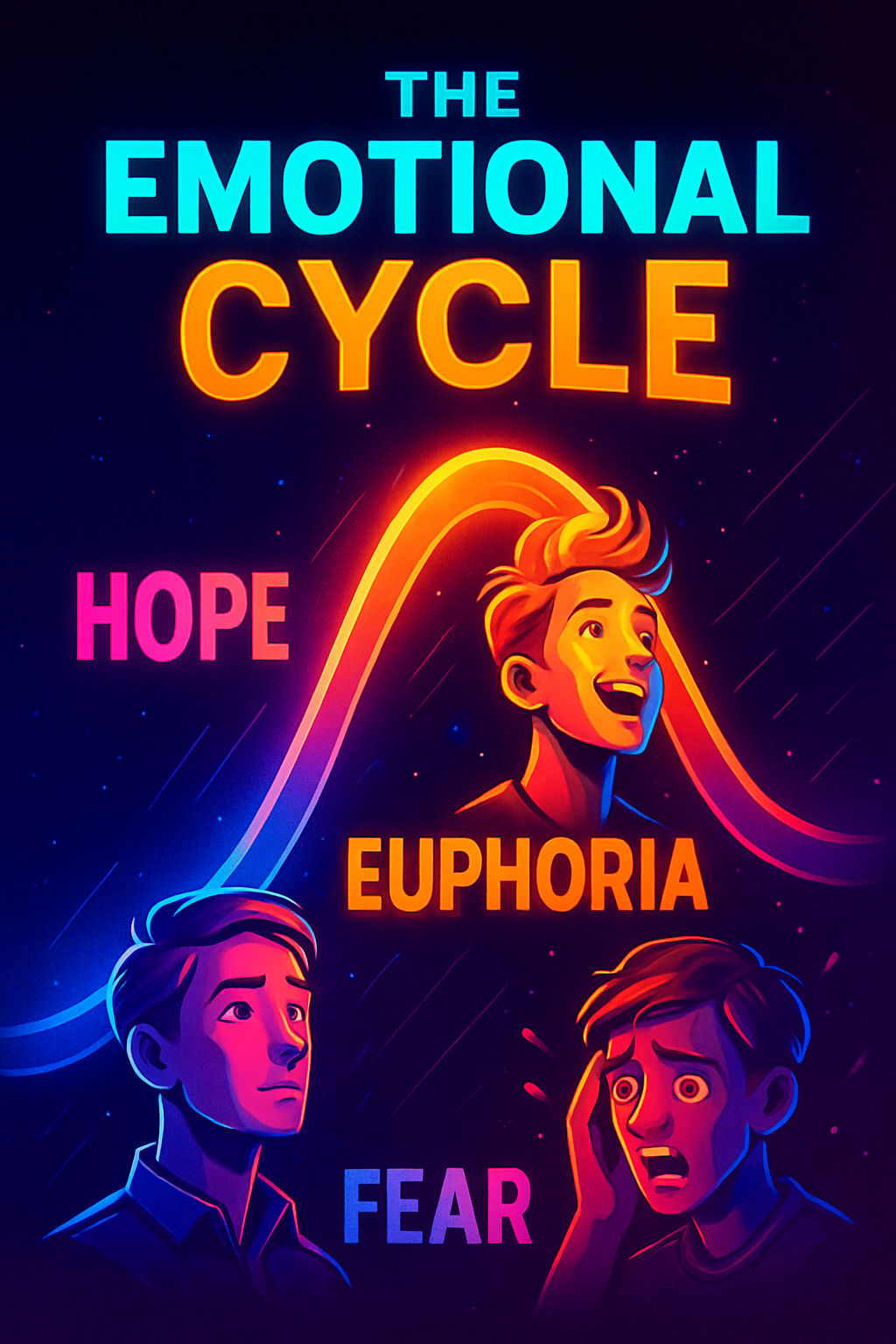

Understanding Market Cycles — From Hope to Euphoria, Fear, and Back Again

Greetings CryptoCubers!

Welcome back to your weekly dose of crypto clarity — where we simplify, inspire, and move forward together on this digital frontier.

Market Pulse — This Week's Price Update

Bitcoin (BTC): ~$95,864

Ethereum (ETH): ~$3,208

Solana (SOL): ~$141

Remember: Prices are approximate and may vary across platforms. Always zoom out and think long-term.

Topic of the Week: Understanding Market Cycles in Crypto

Crypto markets can feel wild — but beneath the volatility lie predictable patterns called market cycles. These cycles teach us when to stay calm, when to accumulate, and when to take profit.

Let's break it down.

The 4 Key Phases of Every Crypto Market Cycle

1. Accumulation Phase

Prices are low and stable.

Traders are absent, and sentiment is flat or negative.

Smart investors quietly position themselves.

“When others aren’t looking, the wise are building.”

2. Markup Phase

Prices start rising with increasing confidence.

New participants and media interest emerge.

FOMO slowly kicks in.

“Everyone suddenly wants in.”

3. Distribution Phase

Prices hit new highs, and excitement is everywhere.

Seasoned investors start offloading.

Retail investors often enter at the top.

“This time it’s different!” (Spoiler: it’s not.)

4. Markdown Phase

Prices decline or move sideways.

Fear returns. Many exit at a loss.

“Crypto is dead.” (Again.)

History Repeats: Major Crypto Cycle Examples

2013 Bull Cycle

BTC surged from ~$100 to $1,000.

Market cooled off for nearly 2 years after.

2017-Mid 2018

BTC peaked near $20,000.

ICO mania fueled hype and thousands of new projects.

Large correction followed; many projects disappeared.

2020–2021 Cycle

BTC hit $69,000 driven by institutional adoption, NFTs, DeFi.

Major pullback in 2022, testing investor conviction — but those who held saw recovery begin by late 2023.

🧠 The Psychology of Market Cycles

Cycles aren’t just about price — they’re human behavior on display:

Phase | Emotion | Common Mistake |

|---|---|---|

Accumulation | Skepticism | Ignoring good opportunities |

Markup | Optimism/FOMO | Buying without strategy |

Distribution | Euphoria/Greed | Overexposure |

Markdown | Fear/Panic | Selling everything or quitting |

👉 Lesson: The market tests your emotions just as much as your investments. Awareness is your anchor.

🔭 Zoom Out: Why Cycles Are Your Friend

Crypto is still young and evolving.

Each cycle brings new infrastructure, tech, and opportunities.

Zooming out shows how far we’ve come—and why it’s not too late.

When in doubt:

Stay calm. Stay educated. Stay invested (wisely).

What You Can Do This Week

Define your strategy: Are you a hodler? Swing trader? Builder?

Recognize the phase we’re currently in and adjust expectations.

Use the quiet times: Learn skills, explore projects, secure your setup.

Track sentiment: Follow the crowd, but watch for herd mentality.

Stay the course: Smart investors ride cycles, not chase peaks.

Final Thoughts

Crypto cycles aren’t roadblocks — they’re roadmaps.

If you stay aware, emotionally grounded, and committed to learning, you’ll do more than just survive — you’ll thrive.

Whether this is your first cycle or your fifth, you're exactly where you need to be. Remember:

“Discipline outweighs excitement in the journey to financial success.”

Until next week — stay alert, stay curious,

Blessings

— The CryptoCube Team